5th 3rd Atm Cash Deposit Restriction

Posts

Store a duplicate associated with the listing in the a safe location during the family, and consider taking photos of beneficial things. Disasters wear’t discriminate, even though our belongings are made to have comfort, lender vaults are created to undergo. Be it fireplaces, floods, earthquakes, or tornadoes, items in a safe deposit container remain unscathed.

Searching Mastercard Increase Restrict

But not, there are certain limitations to your sort of inspections that may be placed, such 3rd-team monitors or checks that will be more than 6 months old. The newest Chase Cellular Deposit limitation is decided considering some things, together with your account kind of, timeframe since the a good Pursue customer, along with your put record. For those who have an extended-status connection with the bank and you will a good deposit listing, you happen to be qualified to receive increased put restriction. The fresh Pursue Cellular Put restrict is the restrict level of currency to deposit by using the Chase Mobile application.

- The fresh mobile deposit limit in the Merrill Lynch are $ten,100 a day and $twenty-five,one hundred thousand monthly for individual subscribers.

- Some accounts have lead deposit or minimal balance requirements so you can qualify for the highest said interest.

- Immediately after a mobile deposit could have been filed, it can’t end up being canceled otherwise corrected.

- After you’ve signed inside software, you could get the choice to deposit a.

- Therefore regardless if you are transferring cash at the an automatic teller machine inside an excellent branch otherwise at the a standalone place, a similar restriction usually implement.

Bmo Harris On line Take a look at Put Limitation

- The roundup of the greatest large-interest checking profile does tend to be specific options one to pay more mph’s 5.00%.

- – There are not any restrictions to the level of fund you could potentially withdraw from your account immediately after to make a mobile deposit.

- Once a mobile deposit has been filed, it cannot generally getting canceled.

- If you would like availability your own deposited finance instantaneously, Dollars Application offers an instant Deposit function for a fee.

- Zero, 5th 3rd Financial only allows people so you can put monitors generated payable to your account manager because of cellular look at deposit.

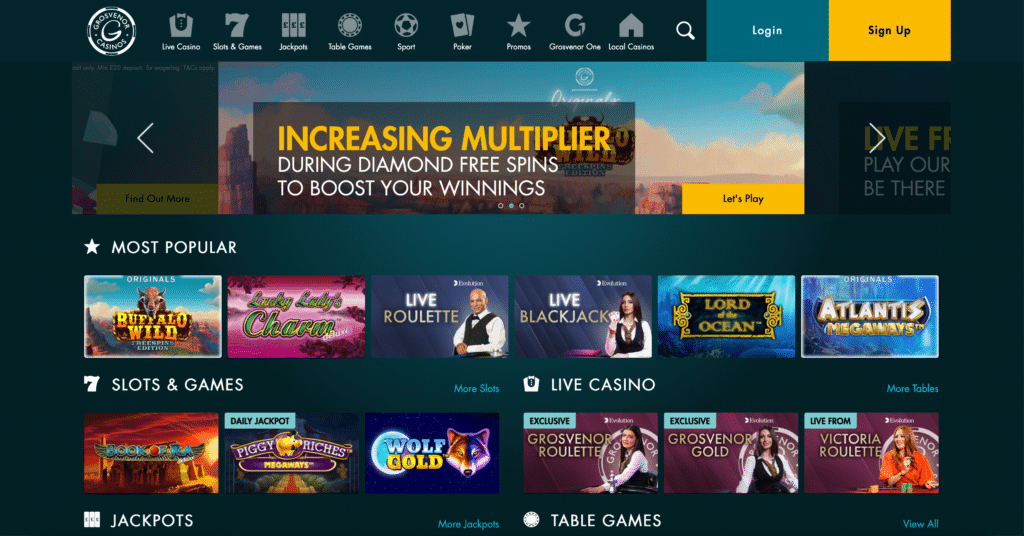

For personal profile, TD Lender have a put restriction of $1,100 a day. As a result you might put up to $1,100000 inside checks instantaneously. Although not, it is very important observe that that it limit may differ founded in your account type and you may relationship with the lending company. Town Federal https://syndicatecasinoonline.com/bitcoin-syndicate/ Lender doesn’t have a certain monthly limitation to have cellular places, however, consumers should know the newest $5,one hundred thousand each day restriction. To use the mobile deposit feature, users need to have a working Town Federal Savings account and be signed up for on line financial. People should also provides a mobile that have a digital camera in order when deciding to take photographs of your own back and front of their monitors to possess deposit.

Following the rules provided by Lender away from The united states and you may remaining track of your own dumps, you possibly can make more for the much easier function. When you yourself have questions or points, definitely get in touch with Financial from The usa’s support service for guidance. Cellular deposit is amongst the of numerous devices that produce handling your finances simpler inside now’s quick-moving industry. Yes, TD Financial’s mobile app enables you to deposit monitors with your mobile phone otherwise tablet.

Highest Credit limit Company Handmade cards

This includes encryption technical to help you secure important computer data and steer clear of unauthorized availability. – Yes, you could put checks from a combined membership proprietor playing with mobile put, so long as you features their permission to do this. – Yes, you could deposit inspections to the a mutual membership having fun with cellular put, if you try detailed because the a free account proprietor. Cellular put is one of the of several easier has one Lender from America offers to the people. Of online financial so you can cellular payments, it try and create handling your finances basic productive.

In reality, of the top 10 highest-paying savings account available today, all except one are available to you when you yourself have $5,000 on hand to help you deposit. A good 5% attention bank account is a kind of savings account one will pay a yearly percentage produce (APY) of about 5%. You’ll must discover the new Varo Savings account, that’s the checking account, to be capable discover the brand new large-produce bank account. If you are indeed there’s no monthly repair payment, customers do need to have no less than $one hundred to start the profile. That it membership doesn’t render monitors otherwise debit cards, and you can Bread Economic doesn’t render examining membership.

Zero, you need to be a member away from SDCCU to make use of its ATMs for cash dumps. Non-participants can invariably make use of the ATMs to help you withdraw cash, take a look at balance, and manage other purchases. Such offers profile, Video game rates will require a serious strike in the latest Fed announcement—along with questioned future price incisions. All of the profile about number supply to help you or next to 5.00% APY it is able to pay zero month-to-month fees and you will different minimum put standards. Think which account may be the finest complement your financial needs and instantaneous discounts means. Directory money offer diversification and also the potential for an even highest return than simply the best 5% attention savings account.